Receiving international payments directly into your bank account has become increasingly important in today’s global economy, and several apps offer convenient solutions to facilitate this process. These apps provide numerous benefits, including enhanced accessibility, efficiency, and cost-effectiveness. Firstly, they allow individuals and businesses to receive payments from clients, customers, or partners located anywhere in the world, eliminating the barriers of distance and time zones. This accessibility is particularly crucial for freelancers, remote workers, and businesses operating in international markets, as it enables them to streamline their payment processes and accelerate cash flow. Additionally, these apps often offer competitive exchange rates and lower transaction fees compared to traditional banking channels or wire transfers, resulting in cost savings for both senders and recipients. Furthermore, many of these platforms provide features such as multi-currency accounts, which allow users to hold funds in different currencies and mitigate currency conversion fees. Overall, the ability to receive international payments directly into your bank account via these apps offers convenience, efficiency, and cost savings, making them essential tools for individuals and businesses engaged in global transactions. here we are suggesting some such best best apps offering this service :

PayPal: One of the most well-known platforms for sending and receiving money internationally. It supports transactions in multiple currencies and allows you to transfer funds to your bank account.

TransferWise (Wise): Known for its low fees and competitive exchange rates, TransferWise enables you to receive payments in various currencies and transfer them directly to your bank account.

Revolut: Revolut offers multi-currency accounts and supports international payments in numerous currencies. You can receive payments directly into your Revolut account and then transfer the funds to your linked bank account.

Payoneer: Payoneer is widely used by freelancers and businesses for receiving international payments. It provides virtual bank accounts in various countries, allowing you to receive payments in local currencies.

Stripe: While primarily known as a payment processing platform for businesses, Stripe also offers the ability to receive international payments directly into your bank account.

Skrill: Skrill allows you to receive money from around the world and transfer it to your bank account. It supports multiple currencies and offers various withdrawal options.

WorldFirst : WorldFirst specializes in international money transfers and currency exchange. It offers competitive exchange rates and allows you to receive payments directly into your bank account.

Remitly: Remitly specializes in international money transfers, particularly for sending money to family and friends abroad. It offers competitive exchange rates and allows recipients to receive funds directly into their bank accounts.

OFX: OFX provides international money transfer services for businesses and individuals. It offers competitive exchange rates and allows you to receive payments in various currencies directly into your bank account.

Xoom: Xoom, a PayPal service, specializes in international money transfers and allows you to receive payments from over 130 countries. You can receive funds directly into your bank account or pick up cash at designated locations.

Airwallex: Airwallex offers multi-currency accounts and international payment solutions for businesses. It allows you to receive payments in multiple currencies and transfer funds directly to your bank account.

Veem: Veem provides global payment solutions for businesses, enabling them to send and receive payments internationally. It offers competitive exchange rates and allows you to receive payments directly into your bank account.

InstaReM: InstaReM offers low-cost international money transfers and allows you to receive payments in various currencies. You can receive funds directly into your bank account in a timely manner.

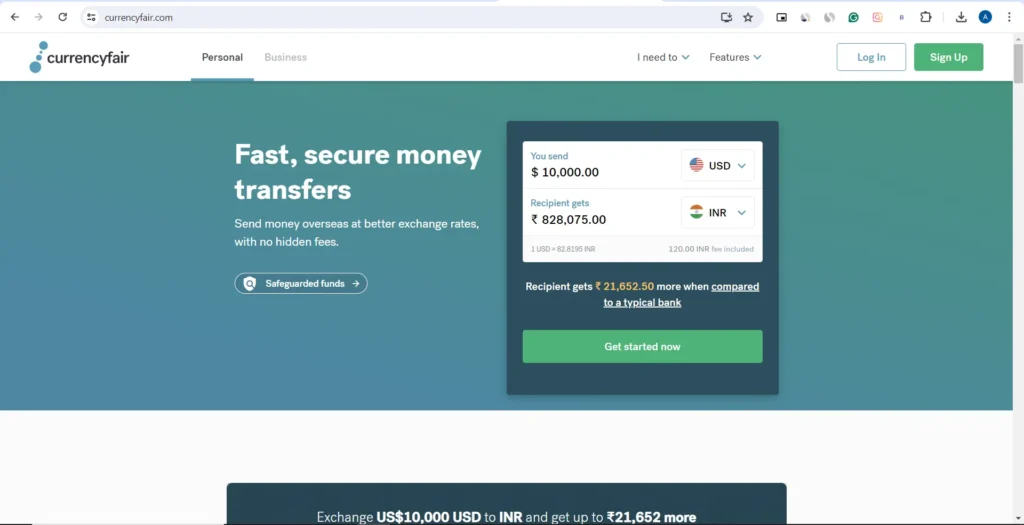

CurrencyFair: CurrencyFair provides a peer-to-peer money transfer platform that allows individuals and businesses to send and receive payments internationally. It offers competitive exchange rates and enables you to receive funds directly into your bank account.

Transfast: Transfast offers international money transfer services with competitive exchange rates and low fees. It allows you to receive payments from around the world and transfer the funds directly to your bank account.

Ria Money Transfer: Ria Money Transfer enables individuals to send and receive money internationally. You can receive payments directly into your bank account or pick up cash at thousands of agent locations worldwide.

MoneyGram: MoneyGram offers international money transfer services with a vast network of agent locations worldwide. You can receive payments directly into your bank account or pick up cash at designated locations.

Western Union: Western Union is one of the oldest and most trusted names in international money transfers. You can receive payments directly into your bank account or pick up cash at Western Union agent locations worldwide.

2Checkout (now Verifone): 2Checkout is a payment platform that enables businesses to accept payments from customers around the world. It offers direct deposit services, allowing you to receive payments directly into your bank account.

WeChat Pay: WeChat Pay is a popular mobile payment platform in China that allows users to send and receive money internationally. You can link your bank account to WeChat Pay and receive payments directly into your account.

Alipay: Alipay is another widely used mobile payment platform in China that supports international money transfers. You can receive payments from Alipay users around the world and transfer the funds directly to your bank account.

When choosing an app or platform for receiving international payments, be sure to consider factors such as fees, exchange rates, supported countries, transfer speed, and ease of use. Additionally, ensure that the platform complies with relevant regulations and offers adequate security measures to protect your financial information.