Budgeting is a fundamental financial practice that involves planning and tracking incomes and expenses to ensure financial stability and achieve financial goals. By creating a budget, individuals gain a clear understanding of their financial situation, allowing them to allocate resources efficiently, prioritize spending, and identify areas where they can save money. Budgeting helps avoid overspending, reduce debt, build savings, and plan for future expenses such as emergencies, vacations, or retirement. Additionally, budgeting fosters discipline in financial habits encourages mindful spending, and provides control over one’s finances, ultimately leading to improved financial well-being and peace of mind.

Budgeting apps offer a convenient and efficient way to manage personal finances by providing tools for expense tracking, budget creation, and financial analysis. These apps allow users to easily input and categorize transactions, automatically sync bank and credit card accounts, and generate detailed reports on spending patterns. Additionally, many budgeting apps offer features such as goal setting, bill reminders, and financial insights to help users stay on track with their financial goals. By leveraging the capabilities of budgeting apps, individuals can gain better visibility into their finances, make informed decisions about their spending, and ultimately work towards achieving greater financial stability and success.

Mint:

Mint is one of the most popular budgeting apps, offering features like expense tracking, budget creation, credit score monitoring, and bill reminders.

YNAB (You Need A Budget):

YNAB focuses on zero-based budgeting, helping users allocate every dollar to a specific category. It offers goal tracking, debt payoff tools, and detailed reporting.

Empower:

Empower is known for its robust investment tracking tools, but it also offers budgeting features like expense tracking, retirement planning, and net worth calculation.

PocketGuard:

PocketGuard connects to your bank accounts and credit cards to track spending and categorize expenses. It also helps users set saving goals and track bills and expenses.

EveryDollar:

Created by financial guru Dave Ramsey, EveryDollar follows the principles of his Total Money Makeover plan. It offers customizable budgeting categories, expense tracking, and debt payoff tools.

Goodbudget:

Goodbudget uses the envelope system for budgeting, allowing users to allocate funds to virtual envelopes for different categories. It offers expense tracking and syncs across multiple devices.

Wally:

Wally is a simple and intuitive budgeting app that tracks expenses, helps users set savings goals, and offers insights into spending patterns.

Albert:

Albert combines budgeting tools with financial advice from human financial experts. It offers features like automated savings, bill negotiation, and investment recommendations.

Tiller Money:

Tiller Money integrates with Google Sheets and Microsoft Excel to provide customizable budgeting templates. It automatically updates transactions and categorizes expenses.

BudgetSimple:

BudgetSimple offers a straightforward approach to budgeting with features like expense tracking, goal setting, and debt payoff tools.

Clarity Money:

Clarity Money offers expense tracking, subscription monitoring, and budgeting tools. It also provides insights into spending habits and suggests ways to save money.

Honeydue:

Honeydue is designed for couples to manage finances together. It offers features like expense tracking, bill reminders, and the ability to share budgets and accounts.

Mvelopes:

Mvelopes uses the envelope system for budgeting and offers features like expense tracking, goal setting, and debt reduction tools. It syncs with bank and credit card accounts.

These apps offer a range of features to help users track expenses, create budgets, and achieve their financial goals, all for free.

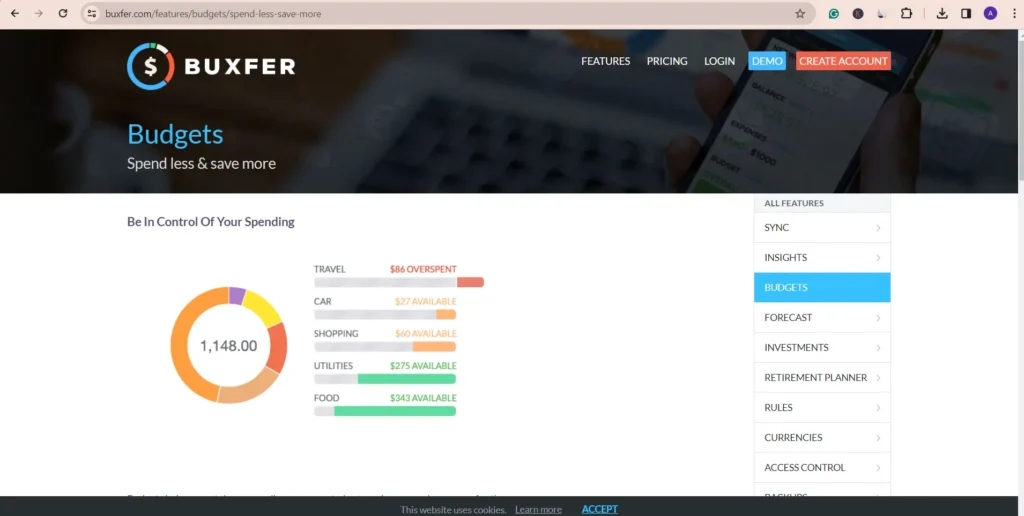

Buxfer:

Buxfer allows users to track expenses, create budgets, and set financial goals. It also offers features like bill reminders, group budgeting for shared expenses, and investment tracking.

Dollarbird:

Dollarbird offers a calendar-based approach to budgeting, allowing users to track income and expenses over time. It offers customizable categories, recurring transactions, and syncs across devices.

BudgetBakers:

BudgetBakers offers expense tracking, budgeting, and bill management features. It also provides insights into spending habits and allows users to set financial goals.

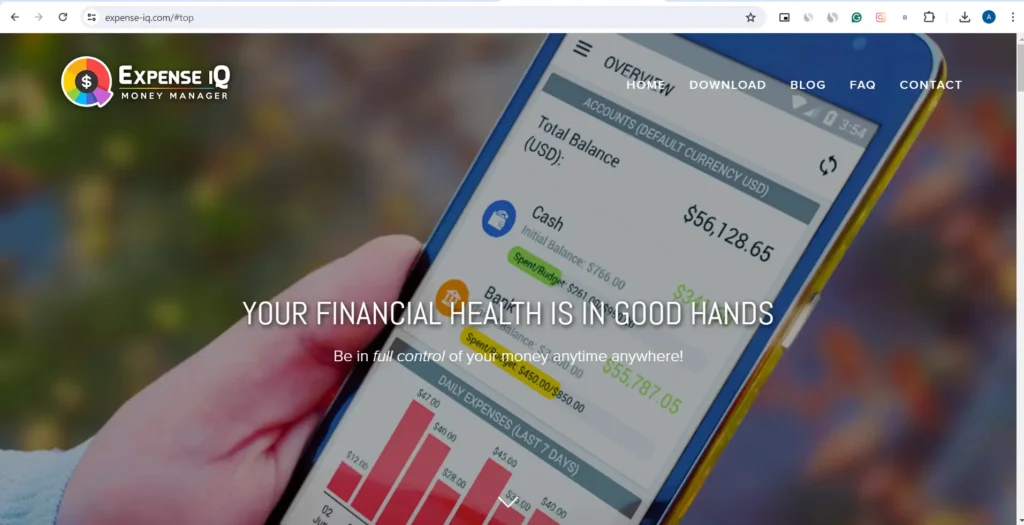

Expense IQ:

Expense IQ offers comprehensive expense tracking with features like customizable categories, bill reminders, and budgeting tools. It also syncs with bank accounts and credit cards.

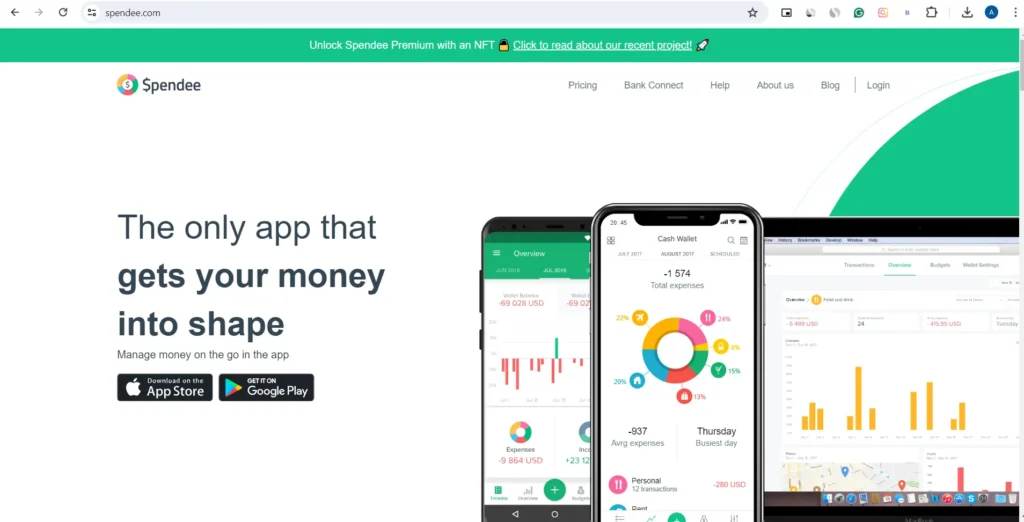

Spendee:

Spendee provides expense tracking, budgeting, and financial insights in an intuitive interface. It allows users to create shared wallets for group budgeting and offers customizable categories.

Money Lover: Money Lover offers expense tracking, budgeting, and bill management features. It also provides insights into spending habits, helps users set savings goals, and syncs across devices.

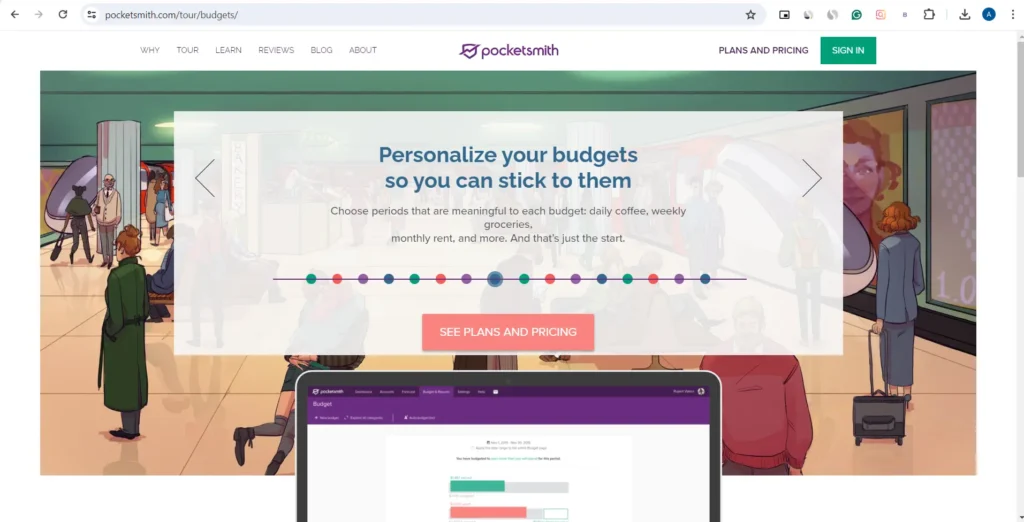

Pocketsmith:

Pocketsmith is a budgeting app that offers advanced features like cash flow forecasting, scenario planning, and investment tracking. It syncs with bank and credit card accounts.

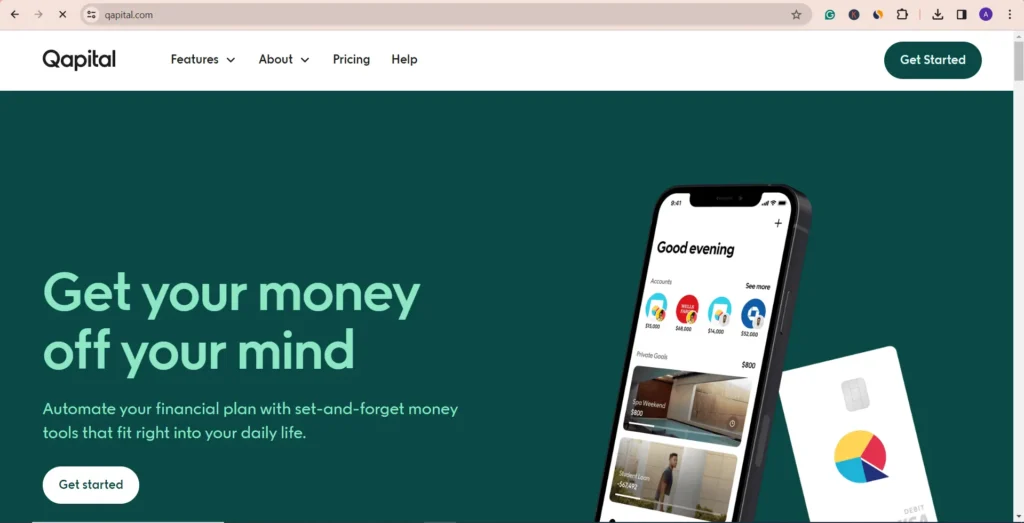

Qapital:

Qapital is a savings-focused app that helps users automate their savings goals. It offers features like customizable savings rules, goal tracking, and insights into spending habits.

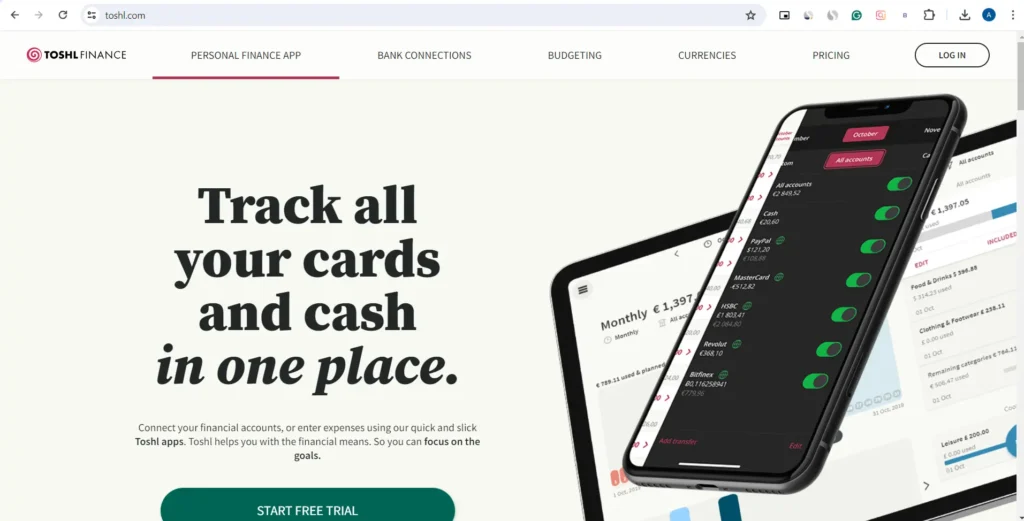

Toshl Finance:

Toshl Finance offers expense tracking, budgeting, and bill management features. It also provides insights into spending patterns, allows users to set financial goals, and syncs across devices.

These budgeting apps offer a variety of features to suit different financial needs and preferences, all available for free with optional premium upgrades for additional functionality. choose the right one that suits you and you can try multiple options too.